The third and final tax amnesty period is here. In just a couple of weeks, the program is expected to reach its targets of redemption fees paid and assets declared. After the end of tax amnesty, should the authorities pick up on undeclared assets, they will impose the appropriate income taxes, with sizeable penalties. A new electronic mechanism is being prepared for launch, enabling access to bank customers’ information for the purposes of tax investigation. However, this once-in-a-lifetime golden opportunity is still here. Seize it.

What are the redemption rates for the final tax amnesty period?

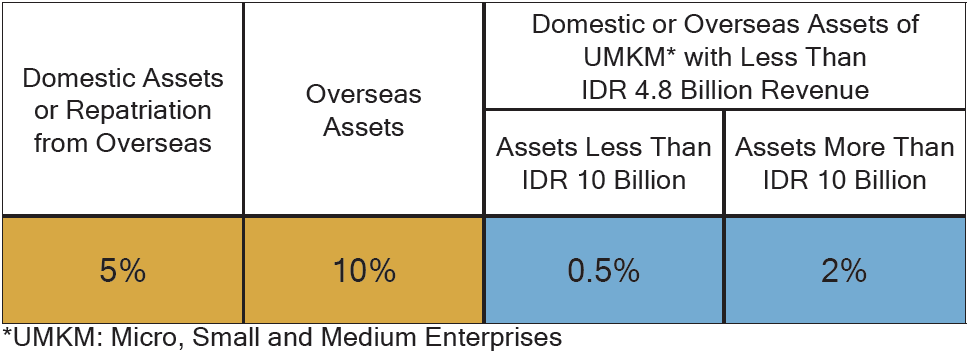

The following redemption rates apply for final period ending 31 March 2017.

Has the tax amnesty program been successful so far?

As of mid-February, the program has reached 63% of the government’s target of IDR 165 Trillion (approx. USD 12.4 Billion) in Redemption Fees paid, whereas in terms of Assets Declared, it has achieved 97% of the Rp 4,500 Trillion (USD 337 Billion).

Meanwhile, the Tax Office has sent letters to the nation’s three banking associations, appealing to customers with over IDR 500 million (USD 37,500) in their accounts to participate in tax amnesty. This appeal program is expected to reach more than a million bank accounts holding a total of IDR 3,000 Trillion (USD 224 Billion). If you received such a letter, do not hesitate to contact us.

To anticipate the final surge of participants and filing of tax returns, starting from 1 March 2017, tax offices will be open 7 days a week.

How will the Tax Office enforce the legal sanctions for those with undeclared assets?

The Tax Office has prepared two “weapons” to enforce legal sanctions for those who have undeclared assets, whether or not they participate in tax amnesty.

The first weapon is Article 18 of Law No. 11 Year 2016 on Tax Amnesty, which states that whether or not you participate in tax amnesty, any undeclared assets found within 3 years of the above Law are considered as income at the time of discovery, subject to the applicable income tax, i.e. up to 30% of the value of the assets, plus the applicable sanctions.

- If you participate in tax amnesty, the sanction is 200% of the taxes incurred. This means that for 30% tax, you could lose up to 90% of the value of undeclared assets.

- If you do not participate in tax amnesty, the sanction is 2% per month for a maximum of 48% of the tax amount. For 30% tax, you risk losing up to 44.4% of the value of the assets.

The second weapon being prepared is electronic disclosure of banking customers’ information, with the ability to pierce the protection of privacy laws. The Tax Office is going straight to where the money is. The new mechanism involves two electronic applications: Aplikasi Usulan Buka Rahasia Bank (Akasia), literally an application to propose the opening of secret banking information; and Aplikasi Buka Rahasia Bank (Akrab), a counter-application for the Financial Services Authority (OJK) to approve such requests. Presently, the Tax Office already has access to banking customers’ information for the purposes of criminal tax investigation. With the duo of Akasia and Akrab applications, the process of obtaining OJK approval is cut short from 8 months to just 1 month, allowing more cases to be investigated, and less lead time and loopholes for banking customers to transfer funds out of the accounts prior to investigation.

Of course, with Automatic Exchange of Information (AEOI), the Tax Office will have access to banking customers’ information not only domestically but also internationally. Indonesia, Singapore, Switzerland and Hong Kong, as well as commonly used tax havens such as British Virgin Islands, are among the 101 countries and territories committed to start exchanging information to combat tax evasion by 2018.

I am still skeptical. I have been in Indonesia for a long time. What is the government doing that is different this time?

Recent high profile cases prove the seriousness of the new tax order:

- Google: The Tax Office issued official investigation results, debunking the internet giant’s claims of IDR 20 Billion (USD 1.6 Million) in revenues and IDR 5.2 Billion (USD 450,000) paid in taxes in 2015. Google’s tax responsibility is estimated instead at IDR 450 Billion (USD 40 Million), based on its control of the lion’s share of total revenues from online digital advertising in Indonesia of USD 830 Million.

- Graft case involving President Jokowi’s brother-in-law, Arif Budi Sulistiyo, who introduced businessman Ramapaniker Rajamohan Nair to Handang Soekarno, former Chief of Sub-Directorate of Source Investigation and Law Enforcement of Taxation. The KPK interrogated 42 witnesses including Director-General of Taxation, Ken Dwijugiasteadi. Ramapaniker and Handang were detained on 21 December 2016 at the former’s residence, moments after the transaction valued at about USD 150,000 was carried out. President Jokowi welcomes the KPK to carry out the legal process on Sulistiyo.

- A former Regional Treasurer of Kabupaten Biereun in Banda Aceh was sentenced to 15 years’ imprisonment for tax corruption between 2007 and 2010 amounting to IDR 27.6 Billion (USD 2.1 Million).

- Wealthy businessman Amie Hamid will stand trial at the South Jakarta District Attorney’s Office for money laundering and creating false tax invoices, and faces 20 years in prison and up to IDR 10 Billion (USD 750,000) in fines.

As an expatriate, may I participate in Tax Amnesty with the lower UMKM redemption rate?

Whether you are a foreign or Indonesian citizen, you may participate using the lower UMKM redemption rate of 0.5% or 2% as long as you meet the requirements.

What are the requirements to qualify as UMKM?

Individuals or entities doing business with annual revenue of less than IDR 4.8 Billion (approx. USD 360,000) may participate in tax amnesty as UMKM. Limited Liability (PT) companies established prior to 2016 could qualify.

If I am employed by a company and receive a salary from my employer in Indonesia, do I qualify as UMKM?

Individuals receiving income from employment relationships in Indonesia do not qualify as UMKM.

Are individual freelancers included in the definition of UMKM? What is the definition of freelance work?

Freelance workers do not qualify as UMKM. Freelance work is defined in Article 11 paragraph (2) of Minister of Finance Regulation No. 118/PMK.03/2016 on the Implementation of Law No. 11 Year 2016 on Tax Amnesty as work carried out by individuals receiving income other than from employment relationship but rather from services based on their specialized expertise. Some examples of freelance work include work carried out by specialized professionals, including accountants, architects, doctors, and consultants; entertainers such as musicians, singers, and actors; sportsmen; trainers, lecturers, and moderators; writers, researchers, and translators/interpreters; project supervisors or managers; merchandise vendors; insurance agents; and multilevel marketers, direct sellers or similar.

Does the UMKM redemption rate apply to overseas assets that I wish to keep overseas?

Yes, the lower UMKM redemption rate of 0.5% or 2% applies to any assets to be declared in tax amnesty, whether domestic, repatriated or overseas.

How do I participate in tax amnesty as UMKM?

For more information, please contact us for the appropriate UMKM tax amnesty solution for you.

This article is not meant to provide standalone legal and tax advice. Specific situations may vary among individuals and corporations. For more information please contact the following:

Putranto Alliance

Jalan Denpasar Raya Blok C4 No. 23

Kompleks Menteri Kuningan

Jakarta Selatan 12950, Indonesia

Tel: +62 21 520 4989

Fax: +62 21 520 4990

Email: [email protected]

Web: www.putranto-alliance.com