To improve the investment climate, the government has recently implemented more business-friendly policies. It is now much easier and more convenient for foreign investors to start a business in Indonesia.

HIGHLIGHTS OF MAJOR CHANGES

Company Registration

Previously, it took at least two months to complete the company registration process. Now, the time has been shortened to one until 1.5 months. Great news for a business establishment in Jakarta: Company Domicile (SKDP) is no longer required, effective since May 2019.

For speedy incorporation (within a week), a shelf company is the ideal solution.

Investor KITAS

Investor KITAS is now available for foreign investors who will fill shareholder, director or commissioner positions. They can start working immediately with an Investor KITAS. The most attractive benefits of the Investor KITAS are the ease of application and the waiver of work permit government fee (DPKK).

Foreigners can apply for either one-year or two-year KITAS, both allowing investors to enter and leave Indonesia for multiple times within the specified validity.

To qualify for an Investor KITAS, a minimum investment of Rp1 billion in invested shares is required, and the invested capital of the company must be over Rp10 billion.

Operating Right Away

The government has added 45 business fields (KBLI) that can start operations once they have obtained a Business Identification Number (NIB) through the Online Single Submission (OSS) system without having to apply for additional licenses such as a tourism license.

The 45 business fields include cargo and logistics, education and/or training, traditional and/or herbal medicine shops, travel agencies (ticketing), other amusement and recreational activities, event organisers, and call centres.

OSS 1.1

OSS 1.1. has been fully synchronised with Indonesia’s Ministry of Law and Human Rights, National Agency of Drug and Food Control (BPOM), as well as regional governments and agencies.

Unlike the previous OSS, OSS 1.1 gives definition to all business actors such as individuals, entity type for non-individuals (PT, CV, Organisation, etc.), and representatives and provides these licensing stages: data legality (both business entities and legal entities), NIB, business licenses, and operational or commercial licenses.

Furthermore, the Foreign Company Representative Office (KPPA) has been included in addition to the Foreign Company Trade Representative Office (KP3A), Foreign Franchise Registration Certificate (STPW), and Construction Service Business Entity (BUJKA). With OSS 1.1, businesses are permitted to register their branch offices and submit the Investment Activity Report (LKPM).

REGISTERING A COMPANY IN INDONESIA

Choosing the right entity is an essential key for a successful start in Indonesia. Although there are several entities to choose from, such as Local Limited Liability Company (PT) and Representative Office, the most common option for foreign investors is Foreign Limited Liability Company (PT PMA).

The foreign ownership for a PT PMA, which allows the employment of foreign workers, ranges from as little as 1-100 per cent and it is determined under the Negative Investment List.

REQUIREMENTS FOR ESTABLISHING A PT PMA

- Structure: For a PT PMA to operate in Indonesia, it should consist of at least one director and one commissioner (one of whom must be an Indonesian), plus two shareholders (who can be foreign or local individuals or corporates, or a combination of both).

- Capital: A PT PMA requires at least Rp10 billion (US$750,000) capital investment, with the paid-up capital amounting to 25 per cent of the total capital.

- Location: Except for Jakarta, a domicile letter is still required when registering a company. Since a residential address is strictly prohibited, a serviced or virtual office is often seen as the best solution.

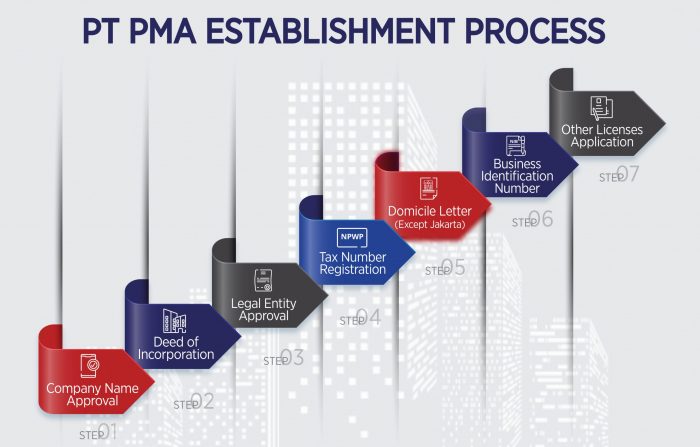

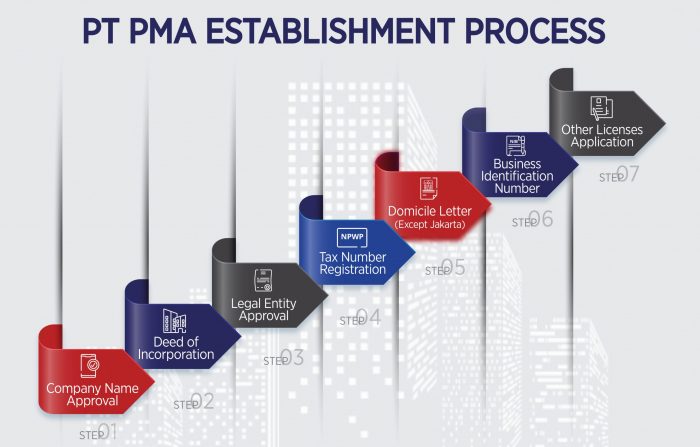

PT PMA ESTABLISHMENT VIA OSS

In general, the establishment process of a PT PMA has to be done online through the OSS in order to obtain the NIB and other relevant licenses.

The process is as follows:

- Approval of company name: it should consist of three words that are not vulgar or obscene.

- Deed of Incorporation: it should include Article of Association, and a notary must be present.

- Approval of legal entity: After submission of Deed of Incorporation by the notary, the Ministry of Law and Human Rights will give approval.

- Registration of Tax ID (NPWP): A valid NPWP is required for securing other company’s licenses, banking activities, and fulfilling tax obligations.

- Domicile Letter: Required to show the location of your business.

- Application of NIB: A unique company profile number that guarantees an immediate operation, provided that no additional licenses are needed. Alongside NIB, Business License(s) and Location Permit will also be granted one day following the registration via OSS. NIB also serves as an import license and customs identification number to be used for the customs clearance process.

- Application of other licenses: Depending on the business sector, additional licenses such as a commercial license and tourism license may be required before operation.

RELOCATION TO INDONESIA: PERMITS AND BANK ACCOUNT

Following the business incorporation in Indonesia, the next steps to take include securing stay and work permits for foreign employees and opening a bank account. To streamline the process, an experienced agent would be of great assistance.

POTENTIAL CHANGES COMING SOON

- Omnibus Law: Despite the recent business-friendly policies, many complicated regulations hampering foreign investments are still found. Through the implementation of the Omnibus Law, thousands of laws are to be amended, including taxation and labour.

- Positive Investment List: The purpose is to encourage more foreign investments in sectors that are partially or fully closed under the Negative Investment List. Also known as the Priority List, the Positive Investment List’s proposed sectors that welcome foreign investments include automotive, coal gasification and electronics, as well as export-oriented and import-substitution.

CONSULT A PROFESSIONAL

Even though this most up-to-date guide should have made it easier for you to incorporate your business in Indonesia, there remain a number of unclear policies and potential changes on regulations.

For first-hand updates on 2020 business incorporation and one-stop solutions on starting a business in Indonesia, consult with a reliable business consultant. Visit www.cekindo.com/expat for a free consultation with our specialist.

As part of InCorp Group, Cekindo is a leading consulting company in Indonesia and Vietnam providing market-entry and corporate services that include company registration, business licenses, product registration, and visas. Become one of our satisfied clients and jumpstart your business now.