It may be a cliche, but when it comes to doing business in Indonesia or anywhere else in the world, this adage will always be true and relevant: fulfilling tax and payroll obligations to ensure compliance is a part of running a business.

Every business in Indonesia, regardless of size and type, has the obligation to register for tax, pay for the compulsory taxes, submit tax reports and file tax returns, and withhold the personal income tax of employees, among other things.

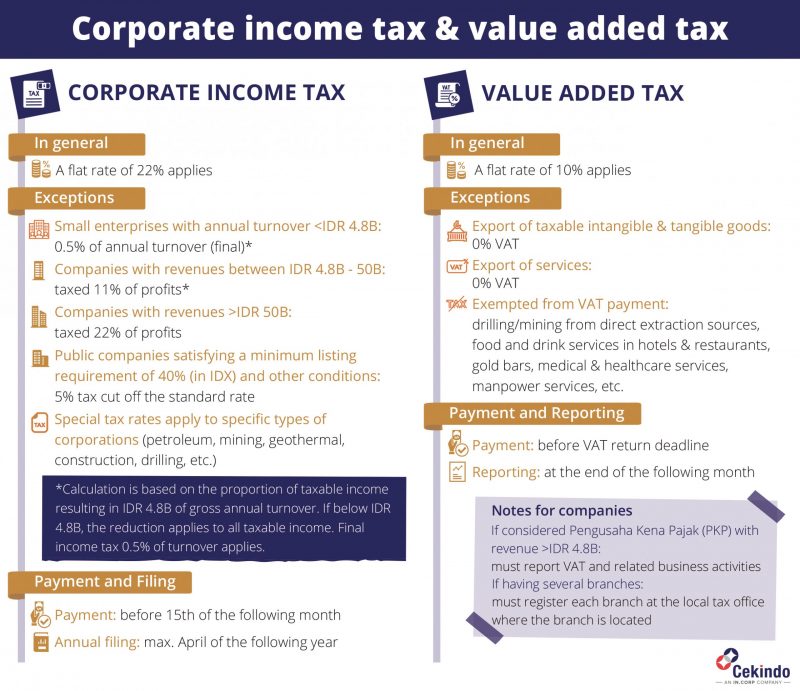

There are many types of taxes in Indonesia, but the most common ones that business owners need to pay attention to are the corporate income tax (CIT) and value-added tax (VAT). Depending on the business classification, activity and location, tax requirements and rates may be different between businesses.

SANCTIONS AND PENALTIES FOR TAX NON-COMPLIANCE IN INDONESIA

Cases of non-compliance in Indonesia can be classified into non-severe and severe, and sanctions and penalties incur accordingly. For example, for a late tax payment companies will be subject to a monthly surcharge of 2 percent. For late tax reporting, depending on the tax type, companies will be fined between Rp100,000 and Rp1 million. Incomplete, late issuance, non-conforming issuance or non-issuance of the VAT invoice will be subject to a surcharge of 2 percent.

Serious tax infringements in Indonesia include providing wrong information for tax returns and not submitting tax returns, which may result in imprisonment of between three and 12 months or a fine of 200 percent of the underpaid tax. Cases of fraud, embezzlement and improper bookkeeping can result in a maximum of six-year imprisonment or a surcharge of 200-600 percent of the actual payments.

PAYROLL COMPLIANCE IN INDONESIA

Companies that employ workers in Indonesia are required to withhold the income taxes of their employees, whether they are local or foreign nationals. By the end of the year, employers will provide employees with their annual tax returns, which are to be submitted to the tax authority no later than March 31 of the following year.

In Indonesia, the income of everyone is subject to a basic tax allowance. Up to the minimum amount, the taxable income is not subject to tax. If the taxable income is higher than the basic tax allowance, they will have to pay for their income tax. As a rule of thumb, the higher a taxable income is, the higher amount they will have to pay to fulfil their tax obligations.

All tax residents, including foreign nationals, should register for the National Taxpayer Identity Card (NPWP). Those without the NPWP are subject to an additional 20 percent charge on their income tax withholding.

The following tax rates can be used as the basic guidance for income tax calculation in Indonesia:

- The first Rp50 million: 5 percent

- The next Rp200 million: 15 percent

- The next Rp250 million: 25 percent

- The next amount over Rp500 million: 30 percent

In addition to the income tax deduction, there are several things to consider when it comes to payroll calculation in Indonesia:

- Minimum salary: the amount varies between regions in Indonesia

- Work hours: 40 hours is usually the standard number of work hours within a week (Monday

to Friday) for employees in Indonesia

- Overtime work: each employee is limited to three hours of overtime per day. The overtime time rate is 1/173 of the monthly salary of an employee

- Allowance: a religious holiday allowance (THR) must be given to all employees. This allowance is an extra income that needs to be separated from the monthly salary. It is usually given either before Eid al-Fitr or Christmas.

- Mandatory insurances: All employees, including foreign nationals who have worked and resided in Indonesia for more than six months, are required to participate in the BPJS Employment Program in Indonesia. This program consists of a healthcare BPJS and a social security BPJS.

BETTER BE SAFE THAN SORRY: OUTSOURCE TO A PROFESSIONAL

Ensuring 100 percent compliance with matters related to tax and payroll is a must when doing business in Indonesia. Otherwise, as mentioned above, your business is at risk of being sanctioned or penalised due to non-compliance.

As a business owner, it may be challenging to understand all of the tax and payroll regulations in Indonesia, not to mention keeping updated with the latest changes at all times. Outsourcing tax, accounting and payroll to a professional will be a smart decision. To understand more about how business process outsourcing can help you and your business, have an expert consultation with us:

https://go.cekindo.com/taxcompliance-indonesiaexpat

As part of InCorp Group in Singapore, Cekindo offers a suite of tax and payroll consultation and outsourcing services. Get rid of those burdens and have peace of mind while running a business in Indonesia with full compliance.